The Mountain Valley Pipeline (MVP) is a 303-mile, 42-inch diameter fracked fuel pipeline that, if accomplished, will stretch from northwestern West Virginia via southern Virginia. It’ll have three compressor stations alongside its route, all in West Virginia, and an hooked up 31-mile pipeline, MVP Southgate, that can develop the transport of fracked fuel into North Carolina.

The MVP was proposed in 2014, but it surely has confronted intense opposition from landowners, Indigenous communities, and local weather advocates, who say the pipeline’s polluting impacts would be the equal of 23 new coal-fired energy crops. Concerted authorized challenges and direct motion protests have stalled the pipeline’s development, and its estimated prices have boomed from an preliminary $3.5 billion practically a decade in the past to $7.2 billion immediately.

The house owners of the MVP obtained a significant present when President Joe Biden struck a take care of West Virginia Senator Joe Manchin, a real fossil gas loyalist, to quicken the approval of the MVP as a part of the June 2023 debt settlement. As an interstate pipeline, the MVP might be regulated by the Federal Power Regulatory Fee (FERC) however will even want permits from different federal and state companies.

As we speak, MVP house owners declare the pipeline is 94% constructed and might be operational within the fall of 2024, although pipeline opponents say that is unfaithful, even in line with the corporate’s personal experiences. MVP house owners have more and more coordinated with “fusion facilities” and native police to extend repression of protesters within the types of arrests, fines, lawsuits, and harsh new state legal guidelines.

Behind the MVP exists a wider energy construction composed of CEOs, board administrators, asset managers, and massive banks who all stand to revenue from the pipeline, and certainly have already got. The names of consumer-facing monetary corporations like Financial institution of America, Wells Fargo, JPMorgan Chase, BlackRock, Vanguard and State Avenue are all propping up and cashing in on the MVP whilst they offer lip service to points like “sustainability” and “net-zero commitments.”

Much more, the primary proprietor and operator of the MVP, Equitrans Midstream, is now being acquired by EQT Company, one of many high fracking firms within the U.S. Executives from each Equitrans and EQT donated huge to Joe Manchin as he extracted approval of the MVP. And a few of the high regulators of the pipeline — together with the chairman of FERC and the heads of essential state environmental companies — have alarming ties to the fossil gas {industry}.

This submit highlights six vital issues that organizers taking up the MVP ought to know.

1. There’s new MVP possession coming

The driving drive behind the MVP over the previous a number of years has been its high proprietor and sole operator, Equitrans Midstream. The MVP’s web site lists Equitrans (the dad or mum firm of EQM Midstream Companions) as having a “45.5% vital possession curiosity” within the MVP. Media experiences have additionally put Equitrans’ stake at 48.1%.

After Equitrans, different events to the MVP three way partnership are NextEra Power (31% possession curiosity; Con Edison Transmission (12.5% curiosity); WGL Midstream (10% curiosity); and RGC Midstream (1% curiosity).

However in early March 2024, EQT Corp, the high fracking firm within the Marcellus Shale area, introduced that it was buying Equitrans in a $14 billion all-stock deal. Equitrans was beforehand a part of EQT Corp however spun off in 2018 into an impartial firm. EQT Corp performed a number one function in driving the fracking increase within the Marcellus Shale area, particularly in Western Pennsylvania, the place they’re headquartered, within the 2000s and 2010s. The corporate grew larger in 2017 when it acquired Rice Power, and present EQT Corp president and CEO Toby Z. Rice — who says the MVP will unleash an “AI energy increase” — was a high government with Rice Power earlier than the acquisition.

The importance of this merger (following its seemingly approval within the fall) for the MVP is that it’s going to quickly have a brand new proprietor: EQT Corp. In buying Equitrans, EQT Corp is becoming a member of a wave of huge fossil gas mergers which are evermore consolidating the {industry} into the arms of some huge gamers. Following the merger, which is contingent on FERC approval of the MVP starting service, EQT Corp says it will likely be price round $35 billion.

2. MVP CEOs rake in tens of thousands and thousands — together with a $7.5 million bonus particularly tied to the MVP — whereas board administrators have highly effective Large Oil ties

Thomas F. Karam is the chairman of present MVP high proprietor Equitrans, and till January 2024 he additionally served as firm CEO. In January 2024, Diana M. Charletta was appointed the brand new CEO of Equitrans.

From 2021 to 2023, Karam took in $39,245,673 in whole CEO compensation, with over half in inventory awards. As a part of that compensation, Karam obtained a whopping $7.5 million money bonus in 2023 “in categorical recognition of his relentless efforts in the direction of navigating authorized and regulatory setbacks to the MVP mission,” notably working with Congress and the Biden administration to win the “legislative achievement” of the inclusion of the MVP within the 2023 Fiscal Duty Act.

The following largest proprietor of MVP after Equitrans is the vitality firm NextEra, whose CEO, John W. Ketchum, took in $40,440,264 from 2020 to 2022.

With MVP possession switching to EQT Corp, the brand new high pipeline government might be EQT Corp CEO Toby Z. Rice, who took in $39,121,426 in whole compensation from 2021 to 2023.

In turning into the brand new house owners of the MVP, Rice and EQT Corp might be ruled by a board of administrators that’s firmly devoted — regardless of verbiage round “clean-burning” pure fuel — to the extracting and burning of soiled fossil fuels, with a number of administrators tied to a few of the strongest and polluting company actors within the {industry}. Board chair Lydia I. Beebe is the previous Company Secretary and Chief Governance Officer of Chevron; Janet L. Carrig is the previous Senior Vice President, Basic Counsel and Company Secretary of ConocoPhillips; Anita M. Powers is the previous Govt Vice President of Worldwide Exploration for Occidental Oil and Fuel Company and Vice President of Occidental Petroleum, in addition to a former director of California Assets Company; and James T. McManus II is the previous Chairman, Chief Govt Officer and President of Energen Company, an enormous Permian Basin driller, acquired by Diamondback Power in 2018.

As LittleSis has beforehand famous, longtime former EQT Corp CEO, President and Chairman Murry Gerber raked in tens of thousands and thousands of {dollars} as he oversaw the corporate from 1998 to 2011 whereas it drove the fracking increase. Gerber has served on the board of administrators of asset administration large BlackRock since 2000, and as its Lead Unbiased Director since 2017. BlackRock is a 7.89% helpful proprietor of EQT Corp (see beneath).

3. MVP house owners donated huge to Joe Manchin earlier than and after he gained approval for the pipeline from the Biden administration

Joe Manchin performed a pivotal function in profitable federal backing of the MVP when he made his approval — and deciding Senate vote – of President Joe Biden’s June 2023 debt deal contingent on Biden and the debt laws accelerating the approval of the MVP

Based on marketing campaign finance filings, within the lead-up and shortly after that settlement, simply 5 Equitrans Midstream staff donated a mixed $25,800 to Joe Manchin, from 2021 to late 2023, together with $10,000 from present CEO Diana Charletta. EQT Corp CEO Toby Rice additionally donated $8,100 to Joe Manchin from 2021 to 2023.

4. BlackRock, Vanguard, State Avenue and different asset supervisor are main house owners of firms that personal and function the MVP

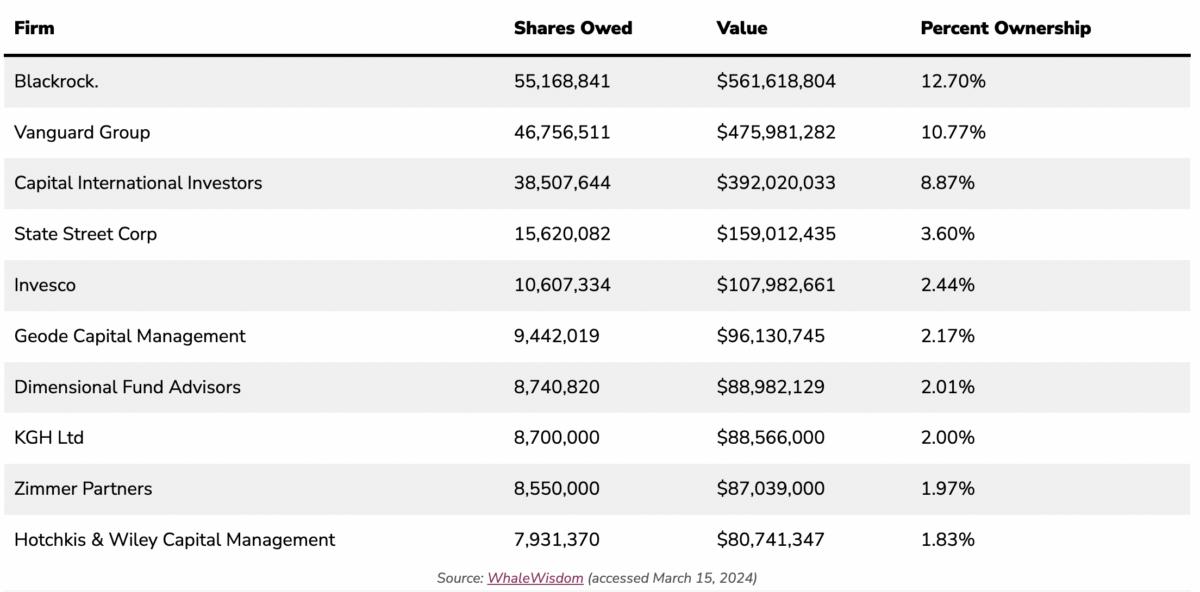

The desk beneath reveals the ten largest shareholders of Equitrans Midstream, the present high stakeholder and operator of the MVP.

Based on Equitrans’s 2024 proxy assertion, it additionally has three high helpful house owners of Sequence A Most well-liked Inventory (that are shares which have precedence when the corporate pays out dividends): CIBC Non-public Wealth Group, D.E. Shaw Galvanic Portfolios, and NB Burlington Aggregator.

The desk beneath reveals the ten largest shareholders of EQT Corp, which is about to turn into the highest stakeholder and operator of the MVP as soon as its acquisition of Equitrans is accomplished. The highest shareholder is T. Rowe Value, one of many world’s largest asset managers with $1.35 trillion underneath belongings, adopted by Vanguard, BlackRock, and State Avenue.

BlackRock, Vanguard, State Avenue, Capital Group and Invesco are high ten shareholders of each Equitrains and EQT Corp. BlackRock, Vanguard and State Avenue are among the many high 4 helpful house owners of each firms. Along with being the highest shareholder of EQT Corp, T. Rowe Value can be the fifteenth high shareholder of Equitrans.

Based mostly on this information, the map beneath reveals the highest shareholders of each present MVP high proprietor and operator Equitrans and near-future MVP high proprietor and operator EQT Corp.

5. Wells Fargo, Financial institution of America and different consumer-facing banks are propping up the MVP

A variety of banks present Equitrans and EQT Corp with financing, within the type of credit score amenities and time period loans, that they’ll draw on to fund the MVP. These embody distinguished consumer-facing U.S. banks, comparable to Financial institution of America, Wells Fargo and JPMorgan Chase. Whereas these banks aren’t offering financing particularly for the MVP, they supply normal funding that the pipeline house owners can use for enterprise operations for the MVP.

Earlier experiences, comparable to 2017 and 2020 experiences by Oil Change Worldwide, have documented the billions in credit score agreements, senior notes, and unsecured loans that 25 banks have supplied MVP’s house owners.

Most of the similar banks proceed to finance present MVP proprietor Equitrans. Based on an April 2022 reinstated credit score settlement submitting, the 21 banks offering a $2.16 billion credit score facility embody:

Wells Fargo serves because the “Administrative Agent, Swing Line Lender and L/C Issuer” on this credit score facility, that means that it oversees and facilitates the day-to-day operations of the credit score settlement with Equitrans, together with in offering short-term loans.

Wells Fargo additionally oversees Equitrans issuing and promoting of bonds to lift capital for the corporate’s enterprise operations. For instance, in February 2024, Equitrans filed a buy settlement of $600,000,000 in senior notes led by Wells Fargo, with Financial institution of America, Citigroup, JPMorgan Chase, PNC financial institution and others initially buying tens of thousands and thousands every in Equitrans bonds.

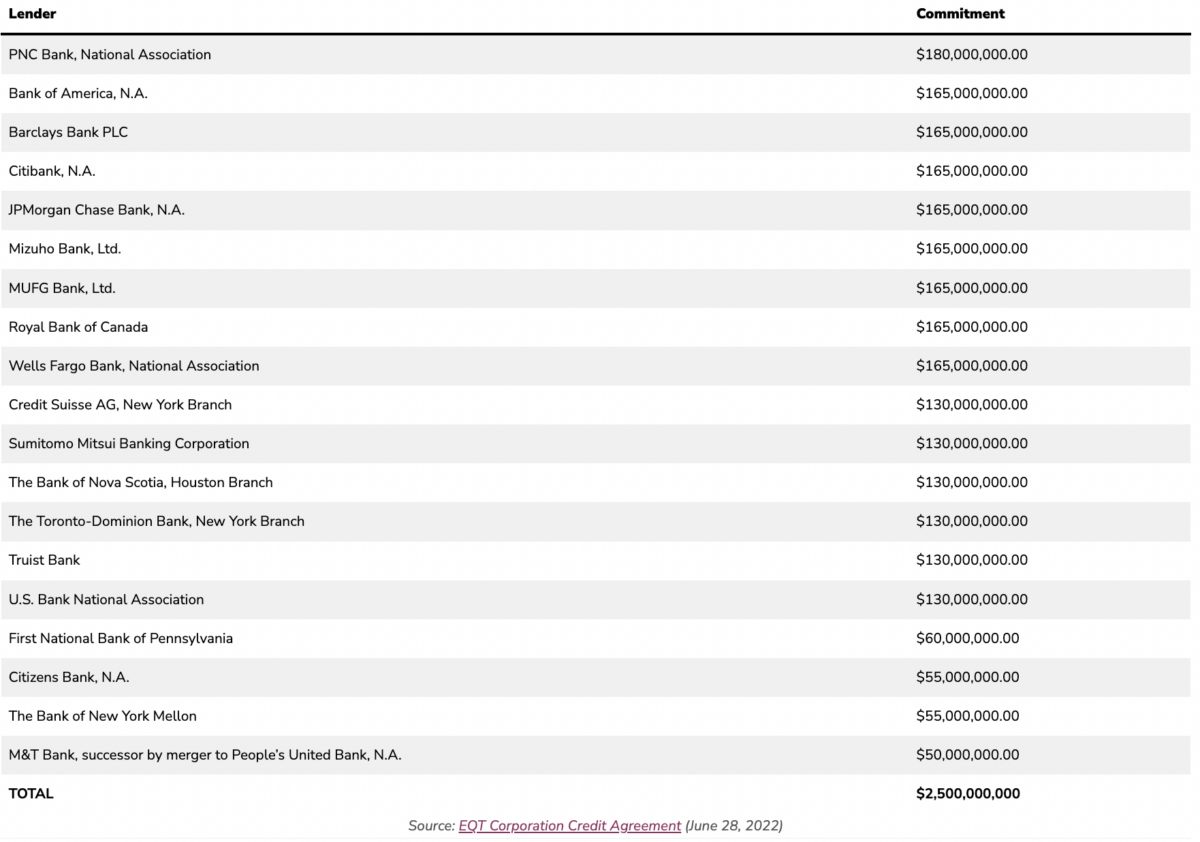

Whereas these banks have been financing Equitrans, they are going to proceed to finance the primary firm behind the MVP whilst its possession modifications to EQT Corp. For instance, EQT Corp disclosed a $2.5 billion credit score facility (referenced of their most up-to-date 10-Ok annual report) in June 2022 whose Administrative Agent is PNC Financial institution and which additionally consists of Financial institution of America, Wells Fargo, Citibank, JPMorgan Chase, and others as lenders:

In January 2024, EQT Corp introduced an amended credit score settlement for $750,000,000. EQT Corp is financed by these banks in different methods: for instance, a September 2022 settlement to problem and promote $1 billion in senior notes with maturity dates of 2025 and 2028.

In financing the businesses behind the MVP, these banks face substantial monetary and reputational dangers. The MVP has confronted fixed delays, with its prices booming. Equitrans 2024 outlook was downgraded by an evaluation in early March due to “a confluence of challenges” that embody “operational delays and monetary headwinds.” Upon EQT Corp’s announcement of its acquisition of Equitrans, Reuters reported that traders had been “unimpressed” by EQT’s debt ranges, and its share value dropped by 8%.

Furthermore, the MVP is simply the tip of the iceberg in relation to financial institution financing of fossil fuels and environmental injustice. From 2016 to 2022, Financial institution of America has supplied $279.73 billion in financing to the fossil gas {industry}, Wells Fargo has supplied $316.7 billion, and JPMorgan Chase has supplied $434.154 billion, in line with the most recent “Banking on Local weather Chaos” report.

6. Key pipeline regulators have ties to the oil and fuel {industry}, together with the MVP itself

Key regulatory companies, from the federal to the state ranges, are led by regulators who’ve quick previous ties to the oil, fuel and utility industries.

Most egregiously, a March 2024 investigation by the Roanoke Occasions discovered that Michael Rolband, who has served as Director of Virginia’s Division of Environmental High quality since 2022, previously ran a consulting agency, Wetland Research and Options Inc., that was employed by the Mountain Valley Pipeline to “present recommendation on coping with the impacts of operating a 42-inch diameter pure fuel pipeline via streams and wetlands.” The investigation mentioned that previously Rolband had been “paid an hourly price” by MVP for his consulting.

The VA DEQ is without doubt one of the key state regulatory companies overseeing the MVP, which partially runs via Virginia. Based on the investigation, on the time Rolband was appointed as Director of the VA DEQ, the company “had cited Mountain Valley with greater than 300 violations of abrasion and sediment management rules throughout development” and fined the corporate $2.15 million in 2019 as a part of a consent decree to crack down on future violations. However from the summer season of 2023 to March 2024, underneath Rolband’s authority, Mountain Valley “has to this point been cited for simply two violations of the consent decree and fined $2,500,” in line with the investigation.

At present, Mountain Valley Pipeline can be proposing MVP Southgate, a 31-mile addition to the MVP that might run from Virginia into North Carolina. Whereas it wants FERC approval as an interstate pipeline, MVP Southgate would even be regulated by the North Carolina Division of Environmental High quality.

Elizabeth Biser has headed the North Carolina company since 2021. Whereas Biser lists seeming environmental bona fides like beforehand serving as Vice President of Coverage and Public Affairs of the Recycling Partnership, these ties elevate questions on her closeness to the fossil gas {industry}.

The Recycling Partnership is an industry-backed group that’s funded by main firms and organizations with a vested curiosity in fossil gas and fossil fuel-based plastics manufacturing, together with ExxonMobil, the American Chemistry Council, and dozens of firms that depend upon single-use plastics wrapping.

Throughout 2020 and 2021, Biser served as one in every of their chief lobbyists, lobbying for the Recycling Partnership each via her personal agency, Biser Methods, and as an in-house lobbyist for the Recycling Partnership.

Throughout that point, lobbying efforts that Biser was concerned in, both solely or as a staff, reported $650,000 in bills. The filings had been sometimes obscure about points lobbied on, comparable to “[m]atters associated to recycling packages and the round economic system that contain insurance policies and proposals affecting federal, state and native recycling initiatives.”

In 2017, Biser additionally submitted lobbying filings in North Carolina for United Oil of the Carolinas, which provides gas from BP, Shell, Marathon, ExxonMobil, and others, although it’s unclear if she did any precise lobbying. In North Carolina in 2017 and 2018, she additionally lobbied for Blue Fuel Marine, Inc., which describes itself as “a pacesetter within the marine {industry}, pioneering pure fuel fueling options for boaters all over the world.”

Maybe most alarming, Willie L. Phillips, the chairman of FERC, the important thing federal physique company regulating the MVP, has longtime and in depth ties to the fossil gas {industry}. Biden’s appointment of Phillips to chair FERC, which should approve the MVP, was strongly opposed by a whole bunch of local weather teams.

The American Prospect has documented Phillips’ coziness with utilities and oil and fuel firms as an legal professional and regulator. Phillips beforehand labored at two regulation corporations, Van Ness Feldman and Balch & Bingham, the place he represented purchasers within the vitality {industry}, together with fossil gas utility large Southern Firm.

As chair of the District of Columbia’s Public Service Fee (DCPSC), Phillips “present[ed] excessive loyalty” to utilities Pepco and Washington Fuel, and he voted in favor of Exelon’s takeover of Pepco, deepening monopoly consolidation of the utility {industry} and “disincentiviz[ing] Pepco from greening their electrical companies, as a result of different Exelon-owned firms depend on fossil vitality for his or her income—to not point out that Exelon has traditionally fought to kill wind and photo voltaic subsidies in favor of soiled vitality.”

Phillips additionally served alongside fossil gas subject companies and utility representatives on the Keystone Coverage Power Middle board and the Electrical Energy Analysis Institute Advisory Council.

Whereas Biden’s debt deal was a lift to the MVP, its completion and operation is not assured. Opponents have succeeded in stalling and delaying the pipeline for years, and the monetary solvency and political destiny of latest fossil gas infrastructure initiatives can swing wildly. As neighborhood members, landowners, and local weather advocates proceed to attempt to halt the pipeline, it’ll assist to comply with the cash and perceive the financing and networks behind the pipeline’s house owners — each previous and new.

Earlier than you go: Truthout faces a critical risk after 22 years of publishing.

Truthout has been a stalwart impartial information publication for over 20 years. Since our founding in 2001, we’ve relied on reader donations to fund our work. And by eschewing company cash and promoting, we preserve our journalistic integrity and by no means need to compromise on ethics.

However immediately, Truthout faces a disaster. As social media algorithms de-prioritize information content material, fewer readers ever make it to our web site. We’ve seen hefty losses in donations consequently.

To make up for these losses, we’re asking our readers to assist us on a month-to-month foundation. Month-to-month giving is completely important to maintain Truthout on-line now and sooner or later. Proper now, we’re working so as to add $375 in month-to-month donations within the subsequent 24 hours. Please, think about making a month-to-month (or one-time) present immediately.